AWARD-WINNING

Portfolio Management & Reporting Software

Portfolio Management & Reporting Software

Purpose Built for UHNWIs & Sophisticated Family Offices

AWARD-WINNING SOFTWARE

We are honored to be recognized for our commitment and dedication to revolutionizing how private wealth is analyzed, reported, and managed.

OUR PLATFORM

INTELLIGENT AGGREGATION

Seamlessly collect, aggregate and normalize investment data from over 400 data feeds across 5 continents, capturing 3x more transactions than other aggregators.

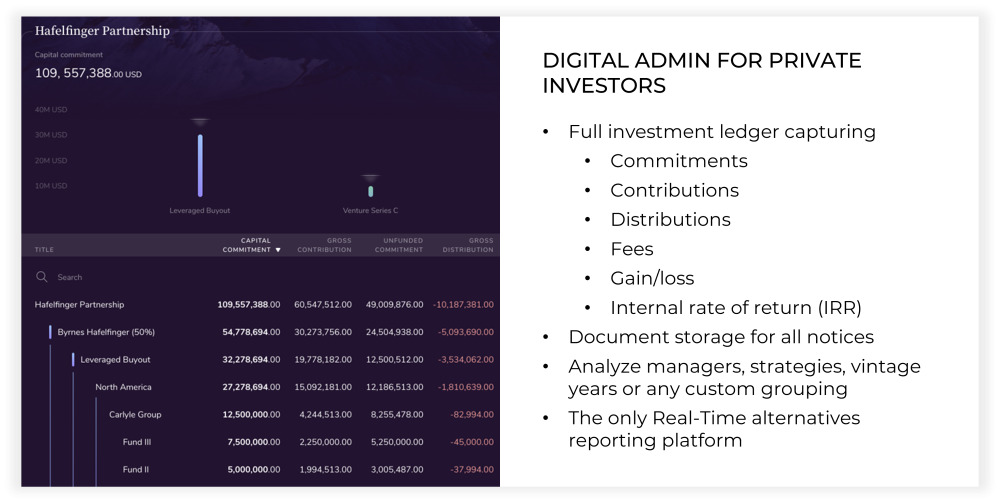

PORTFOLIO ACCOUNTING

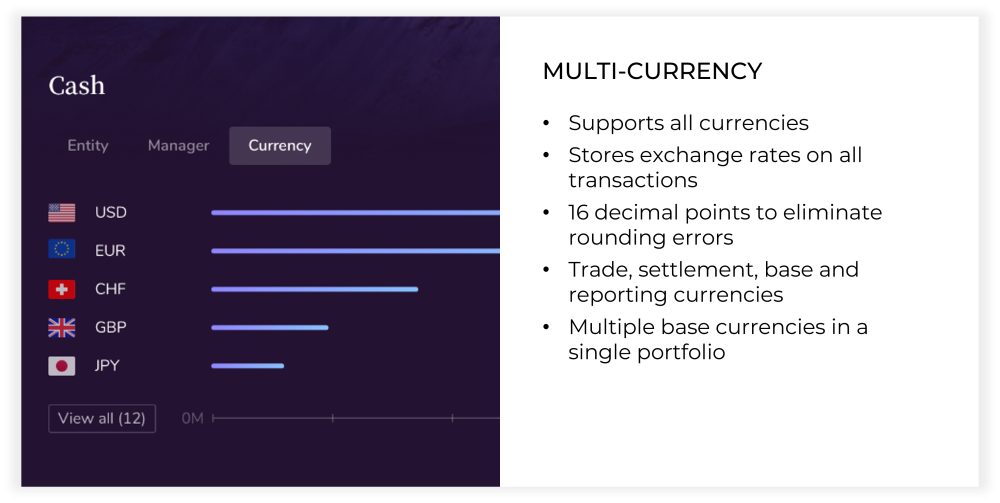

Our award-winning unique data model offers the advantage of having the data integrity of a general ledger accounting system with the flexibility and control of a reporting system.

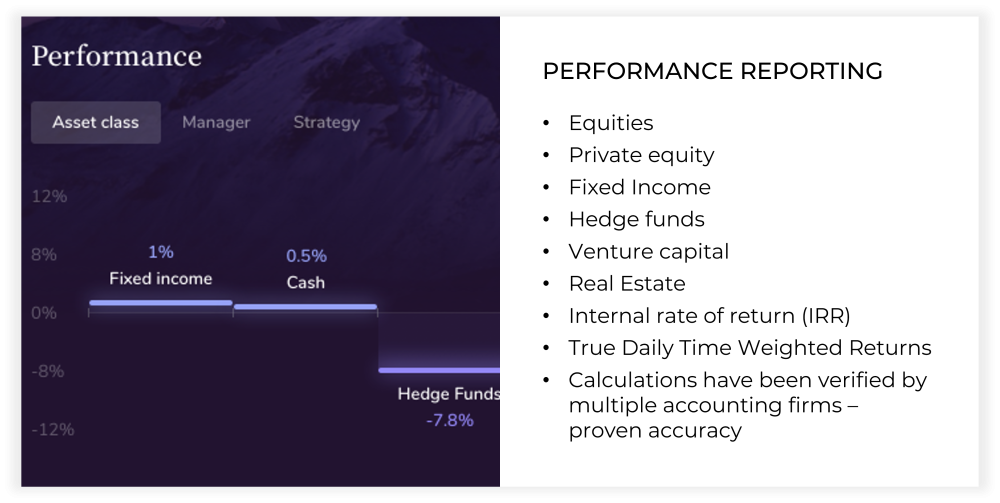

PERFORMANCE REPORTING

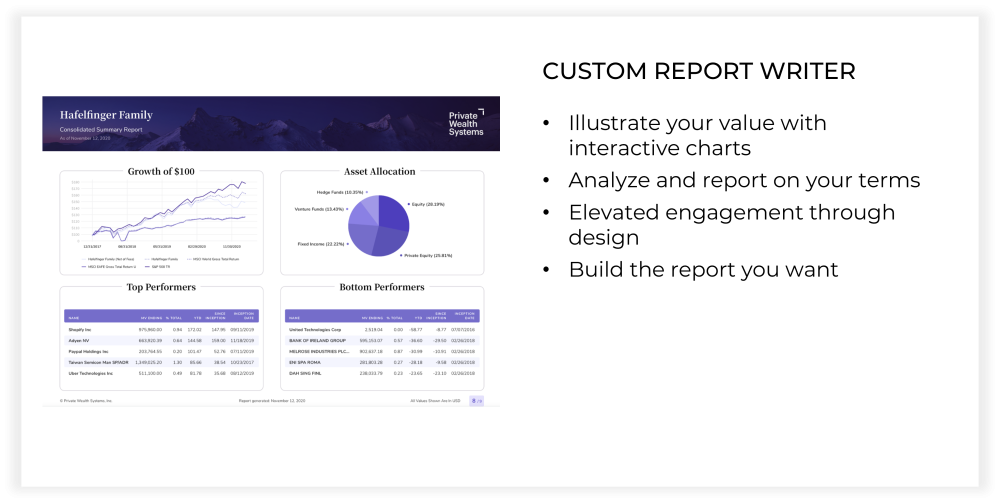

Our award-winning reports and design enables each individual to see the information they want, structured, and formatted the way they want for personalized engagement.

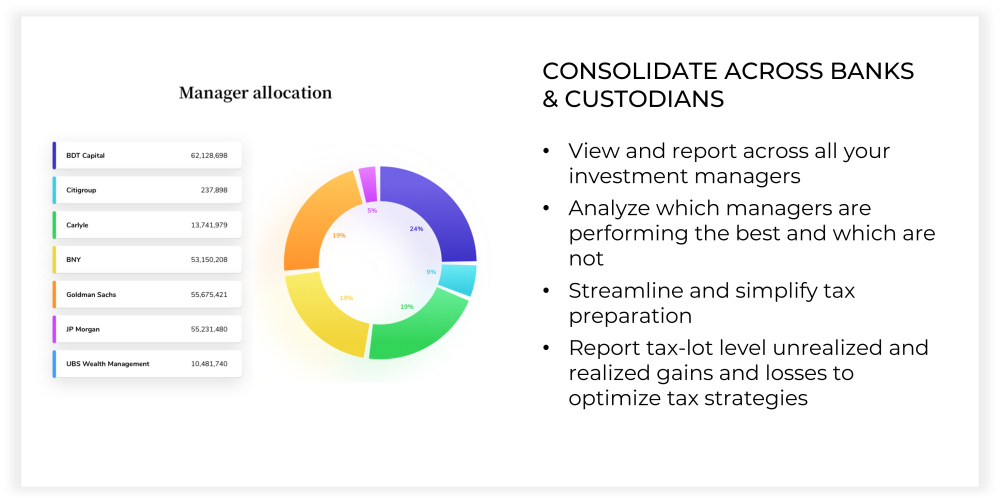

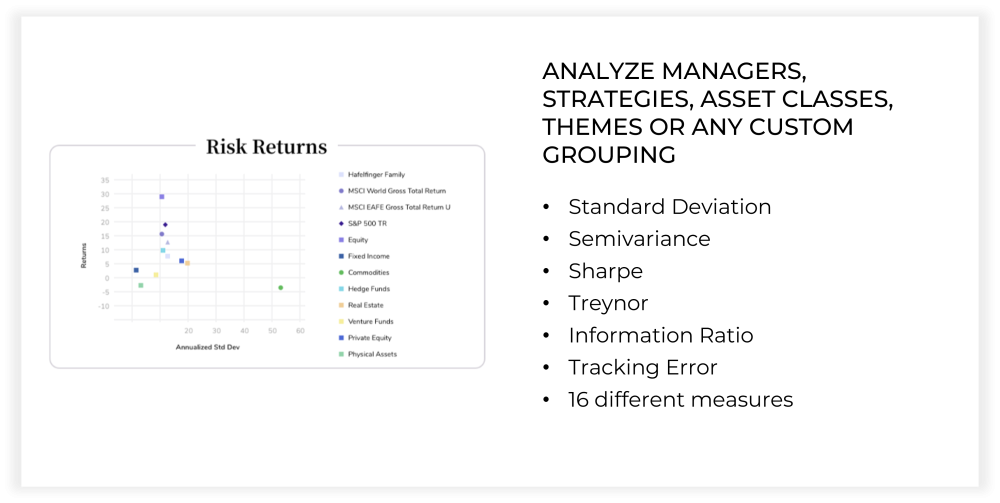

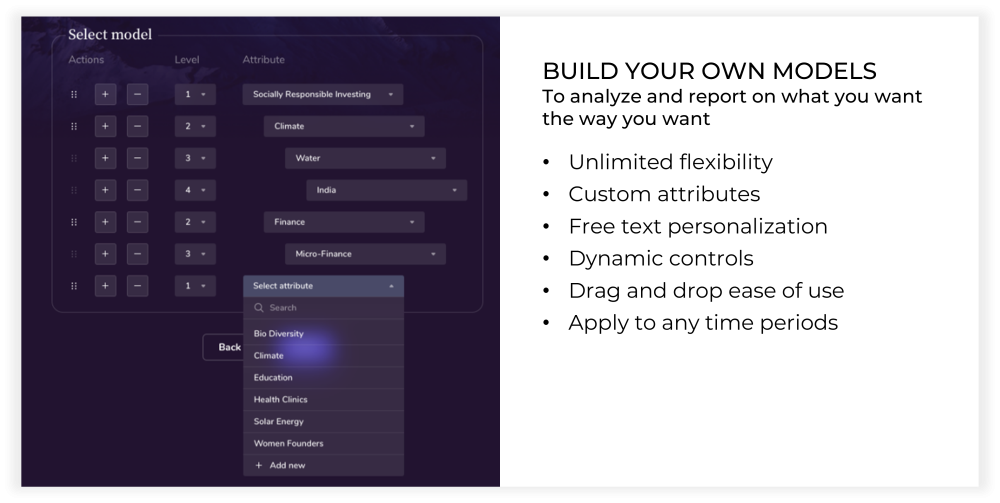

PORTFOLIO MANAGEMENT

View every asset class while using our industry-first data model that allows each stakeholder to classify and structure their data any way they want for faster and more personalized analysis and decision making.

INVESTOR

PORTAL

Our secure, point-click investor portal is designed to provide simple, context-based navigation so wealth owners and advisors can easily gain oversight over the most complex global wealth.

CUSTOM REPORT WRITER

Craft tailored reports on multi-generational wealth from scratch or using our report library. Visualize, personalize, and share—exactly the way you want—to empower informed decision-making.

A Financial Firewall for Bank Data Errors

We have the data and reporting we want at our fingertips, while saving substantial time in-house. This has allowed us to see the forest from the trees in ways that continuously benefit our business.

SINGLE FAMILY OFFICE